Most bonds and structured products trade “over the counter” (OTC), meaning the trade is done directly between two parties, without the centralized supervision of an exchange. Stock exchanges volatility index trading facilitate liquidity, provide transparency, and maintain the current market price. For OTC trades, the price is not necessarily publicly disclosed and liquidity is not guaranteed.

- By selling their interest to someone else, the investor can access the money they need while the company keeps the capital it raised.

- Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns).

- The company will offer prorated rights based on shares investors already own.

On the secondary market, investors purchase securities from one another rather than purchasing from the entity issuing it. Stock exchanges facilitate trading by matching buyers and sellers of stocks quickly and efficiently. They provide market makers who act as guarantors of liquidity by buying or selling stocks when there is no other counterparty available. Stock markets and secondary markets are often thought of as the same thing, but ‘stock market’ is a more general term that includes primary markets as well.

Mortgages are also sold in the secondary market as they are packaged into securities by banks and sold to investors. The main difference between the primary and secondary markets is that the primary market generates capital for companies, while the secondary market creates how to buy tamadoge liquidity (cash flow) for investors. Except for an initial public offering (IPO), all of the trades on a stock exchange, like the NASDAQ or London Stock Exchange, happen between traders. That means that the stock market is almost exclusively part of the secondary market.

Everything You Need to Know About the Bond Market

So, many of the places traders go to buy and sell assets are part of the secondary market. Because each asset gets traded many times, the secondary market makes up the majority of all activity in the financial markets. They yield an enormous number of interconnected exchanges that help to drive securities toward their actual value through supply and demand. “An investor knows what their securities are worth as a result of the interaction between buyers and sellers in the secondary market,” says Johnson. Although not all of the activities that take place in the markets we have discussed affect individual investors, it’s good to have a general understanding of the market’s structure.

- The secondary market provides a guaranteed payment stream for investors, and allows banks to sell loans for a quick premium.

- These trades provide an opportunity for investors to buy securities from the bank that did the initial underwriting for a particular stock.

- Income in this market is thus generated via the sale of the shares from one investor to another.

- If you bought Nubank shares during its IPO, the money went to the company.

- The second type of secondary market is the over-the-counter (OTC) market.

The primary market is where private companies and governments go to raise capital. They issue shares of stock through an initial public offering (IPO) or issue debt through bonds or loans. These financial instruments are created for the first time in the primary market. Without secondary markets, there would be little liquidity for stocks, bonds, and other securities. If only primary markets existed, investors could trade securities only when the initial issuer is interested in buying or selling. After the issuance of the securities, the investors who initially bought them from Microsoft sell them to investors who want to make a profit.

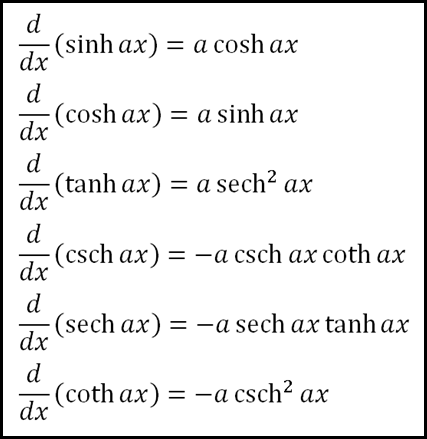

Because access to the third and fourth markets is limited, their activities have little effect on the average investor. Bonds make money for investors by paying a coupon, usually twice a year, based on the bond’s yield. A 4% coupon on a $1,000 bond would pay an investor $40, or $20 twice a year. Investors will also get the principal repaid when the bond matures, but you’ll only make money on the bond that way if you bought it at a discount to its face value. That can happen if interest rates rise or if the government or company borrowing the debt is distressed.

Bond

Typically, shares of new stock are purchased in the primary market by large investors. The money from investors who buy Microsoft’s new stock is used by the company for financing its operations. Some of the most common and well-publicized primary market transactions are initial public offerings (IPOs). During an IPO, a primary market transaction occurs between the purchasing investor and the investment bank underwriting the IPO.

Who Are the Major Players in the Secondary Market?

S&P 500 futures are contracts for the future delivery of the stocks that make up an index of 500 large US corporations at a predetermined price. Finally, understand the rules of any market you participate in and how it is regulated. When in doubt, stick with the large, centralized, well-regulated markets that have rigorous systems to prevent fraud.

In contrast, listed securities are traded among investors in the secondary market. The primary market is the platform for the primary sale and listing of securities on the exchanges, while the secondary market concerns the subsequent trading of the securities. As for the platform provided by a secondary market, it facilitates stock trading and also enables converting securities into cash. Continuous trading in a secondary market also increases the liquidity of traded assets.

Bond market FAQs

After the IPO, most subsequent trading also takes place on the secondary market — with pricing that reflects supply and demand. Investors set the prices at which they are willing to buy and sell a stock. For buying equities, the secondary market is commonly referred to as the “stock market.” This includes the New York Stock Exchange (NYSE), Nasdaq, and all major exchanges around the world. The defining characteristic of the secondary market is that investors trade among themselves.

However, there is growing popularity among companies wishing to raise money in the capital markets via an IPO arrangement called a SPAC (Special Purpose Acquisition Company). The main advantage of a SPAC is that a company has far fewer regulatory requirements and can go “public” in a matter of months. Examples of secondary markets include stock exchanges, bond markets and real estate markets. If initial investors later decide to sell their stock, they can do so on the secondary market.

Due to the one-to-one nature of the transaction, the risk is higher than with exchanges. Fixed income instruments are primarily debt instruments ensuring a regular form of payment such as interests, and the principal is repaid on maturity. Examples of fixed income securities are – debentures, bonds, and preference shares. Plans are self-directed purchases of individually-selected assets, which may include stocks, ETFs and cryptocurrency.

In a secondary market, investors enter into a transaction of securities with other investors, and not the issuer. If an investor wants to buy Larsen & Toubro stocks, it will have to be purchased from another investor who owns such shares and not from L&T directly. All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns. You should consult your legal, tax, or financial advisors before making any financial decisions.

In an exchange-traded market, securities are traded via a centralized place (for example, the NYSE and the LSE). Buys and sells are conducted through the exchange and there is no direct contact between sellers and buyers. Secondary market traders are, almost by definition, economically efficient. Every non-coercive sale of a good involves td sequential indicator a seller who values the good less than the price and a buyer who values the good more than the price. Competition between buyers and sellers creates an environment where ask and bid prices meet at the buyers who value the goods most highly relative to demand. The second type of secondary market is the over-the-counter (OTC) market.

Understanding How the Secondary Market Works

The bond market gives investors the opportunity to invest in a wide range of debt markets, including corporate, government, municipal, mortgage-backed, and emerging markets. The secondary market is where securities are traded after the company has sold its offering on the primary market. The New York Stock Exchange (NYSE), London Stock Exchange, and Nasdaq are secondary markets. Small investors have a much better chance of trading securities on the secondary market since they are excluded from IPOs.